AX Required Documents

Florida Statute 196.1975 provides the guidelines for the exemption for property used by nonprofit homes for the aged.

Back to Homes for the Aged Exemption Detail Page

Organizations applying for exempt status under chapter 196.1975 Florida Statutes which are organized and operated as a Home for the Aged, are required to provide the following:

NOTE: Supporting documents must show the name and address of the organization, the date, an identifiable heading, and be attached to Form DR-504HA

1)A completed Homes for the Aged Ad Valorem Tax Exemption Application and Return (DR-504HA)

2)Individual Affidavit for Ad Valorem Tax Exemption (DR-504S) for each occupant that is signed, dated, and notarized.

3)A copy of the designation letter / corporate acknowledgment from the Secretary of State indicating the applicant is a corporation pursuant to Chapter 617, F.S.

4)A copy of the current non-profit Uniform Business Report (UBR) filed with the Secretary of State

5)A copy of the 501(c)(3) designation / exemption determination letter from the Internal Revenue Service

6)A copy of the building plans and property schematics showing the building and property use. The site plan/building layout will be used to determine the specific square footage of the property that is used for the following:

a)Exclusive religious, nursing, and/or medical services

b)Non-exempt purposes / Common areas (cafeteria, dining hall, office space, bathrooms, walkways, hallways, parking lot, etc.)

7)A copy of all active rental and/or lease contracts for the prior year.

NOTE: Portions of the property that are leased to a private enterprise, including parking lots or garages, do not serve an exempt purpose and are not exempt from taxation.

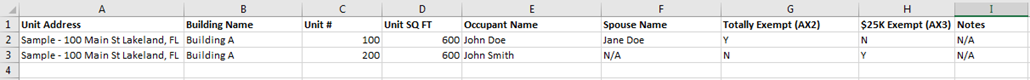

8)A digital spreadsheet that contains a record for each unit/apartment in the home with the following information:

NOTE: This information will be used to ensure the home and the Property Appraiser are able to arrive at the same calculations for the percent of units and apartments that are exempt -- In a home in which at least 25 percent of the units or apartments are restricted to or occupied by persons meeting the AX2 Exemption income requirements, the common areas of that home are exempt from taxation.

1- Unit Address

2- Building Name

3- Unit #

4- Unit Square Feet

5- Occupant 1 name

6- Occupant 2 (Spouse Name)

7- Totally Exempt Status (Y/N) - PCPA EX Code: AX2

8- $25K Exempt Status (Y/N) - PCPA EX Code: AX3

Click here to download a sample spreadsheet

9)A list or inventory of all tangible personal property

NOTE: Tangible Personal Property includes furniture, fixtures, tools, machinery, appliances, signs, equipment, leasehold improvements, supplies, leased equipment, and any other equipment / items other than real estate and licensed vehicles.

10)If the home provides medical facilities, nursing services, or qualifies as an assisted living facility, please provide a copy of the valid license granted by the Agency for Healthcare Administration

11)If the home is financed by a mortgage loan made or insured by the United States Department of Housing and Urban Development (aka HUD Program Project), please provide a copy of the valid approval letter granted by the Department of Housing and Urban Development