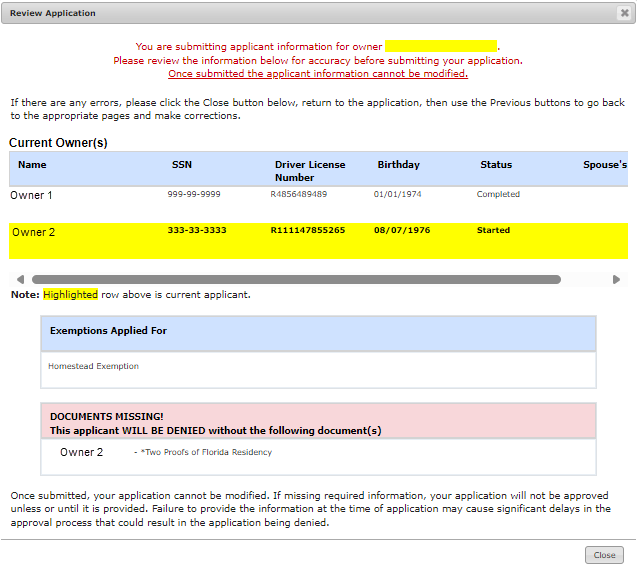

Review Application

After selecting "next" on the "other" exemption tab the review application popup will appear.

This popup contains crucial information from your application, such as any missing required documents. Its purpose is to validate the information you have provided and alert you to any missing documentation so that you can rectify it before finalizing your application. It is important to note that once you submit your application, you will not be able to make any further changes or additions.

Please review all the information displayed to verify the information is correct before closing the popup and continuing on to the signature process.

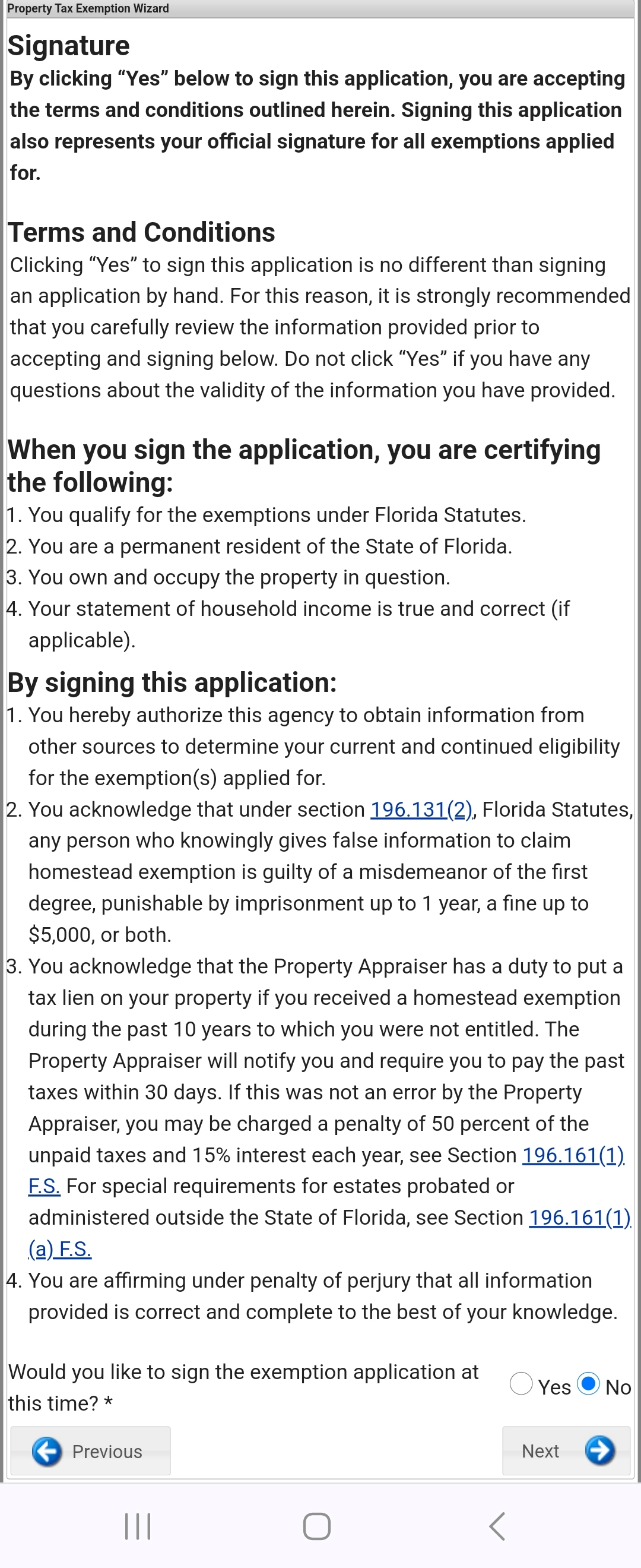

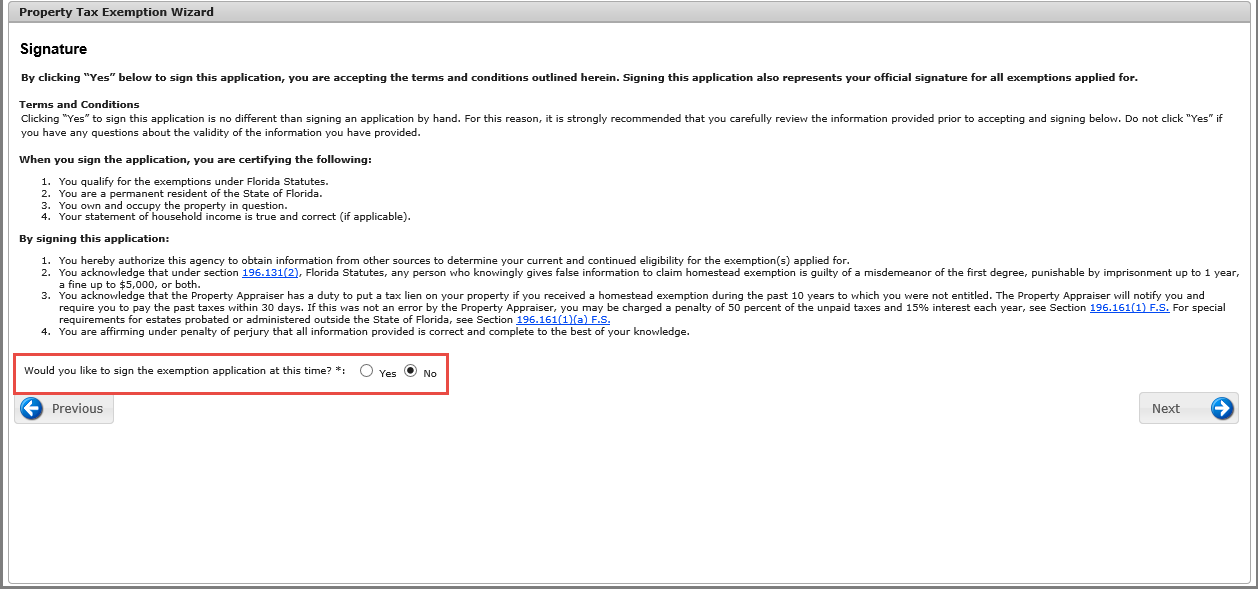

Electronic Signature

The Signature page allows the user to sign and complete the exemption application.

Selecting "Yes" represents the official signature for the exemption application and indicates the user is accepting the terms and conditions outlined. You must accept the terms in order to submit the exemption application.

Selecting "No" will cause the user to receive the error message below.

If you do not wish to accept the terms and conditions, you can close the browser window to discontinue use of the exemption application.

Please take time to review the terms and conditions:

Terms and Conditions

Clicking “Yes” to sign this application is no different than signing an application by hand. For this reason, it is strongly recommended that you carefully review the information provided prior to accepting and signing below. Do not click “Yes” if you have any questions about the validity of the information you have provided.

When you sign the application, you are certifying the following:

1.You qualify for the exemptions under Florida Statutes.

2.You are a permanent resident of the State of Florida.

3.You own and occupy the property in question.

4.Your statement of household income is true and correct (if applicable).

By signing this application:

1.You hereby authorize this agency to obtain information from other sources to determine your current and continued eligibility for the exemption(s) applied for.

2.You acknowledge that under section 196.131(2), Florida Statutes, any person who knowingly gives false information to claim Homestead Exemption is guilty of a misdemeanor of the first degree, punishable by imprisonment up to one (1) year, a fine up to $5,000, or both.

3.You acknowledge that the Property Appraiser has a duty to put a tax lien on your property if you received a Homestead Exemption during the past 10 years to which you were not entitled. The Property Appraiser will notify you and require you to pay the past taxes within 30 days. If this was not an error by the Property Appraiser, you may be charged a penalty of 50 percent of the unpaid taxes and 15% interest each year, see Section 196.161(1) F.S. For special requirements for estates probated or administered outside the State of Florida, see Section 196.161(1)(a) F.S.

4.You are affirming under penalty of perjury that all information provided is correct and complete to the best of your knowledge.

![]()

Mobile Version: