Ways to Apply for an Exemption

There are three easy ways to apply for a property tax exemption:

1.In Person: Visit one of our convenient office locations

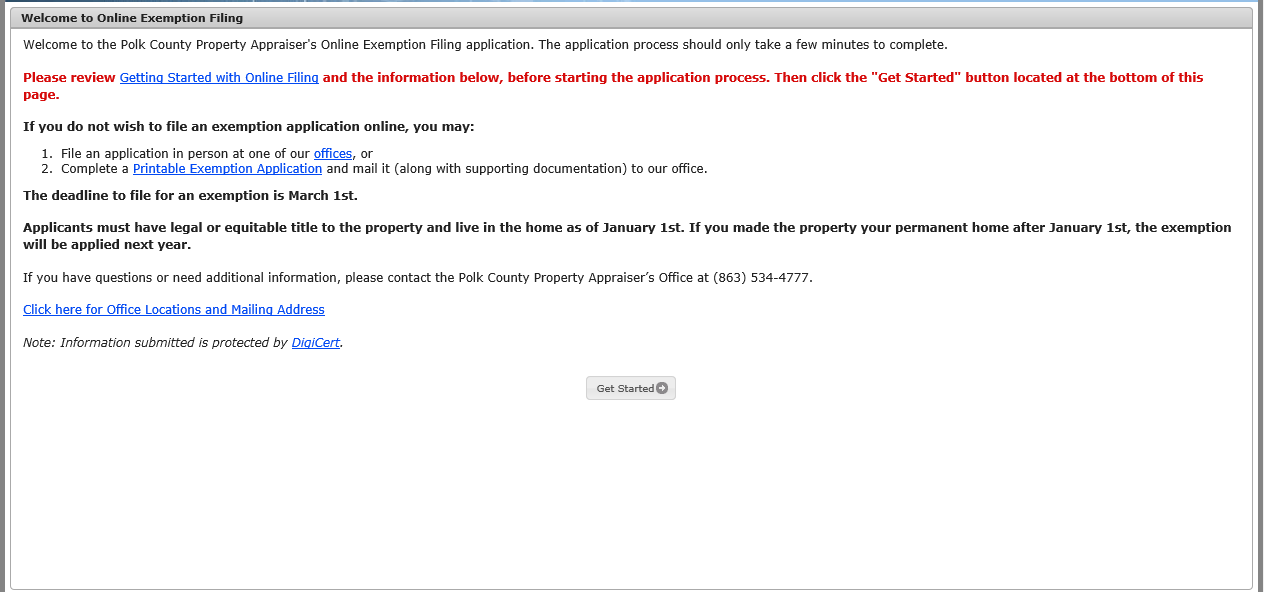

2.Online: Use the Online Exemption Filing Application

3.Mail (USPS*): Mail the completed application for Homestead Exemption (Form DR-501) along with supporting documentation to the Property Appraiser's Office.

NOTE(S): *United States Postal Service (USPS)

The filing deadline is March 1st

All exemption applications are posted on the Department of Revenue (DOR) forms page.

Incomplete applications or applications submitted without the required documentation will not be approved.

NOTE: Please be advised under Florida law, e-mail addresses sent to a public entity are public records and may be released in response to a public records request. Please DO NOT send personal information like SSN, birth dates, etc. via email.

Before You Apply

1.Review Property Tax Exemption Details to determine if you qualify for an exemption.

2.The online application *cannot be completed* without the required items listed below:

•Florida Driver License or Florida Identification Card with Homestead address

•Social Security Number

NOTE: Under Florida law, you are required to update the address on your driver license and vehicle registration within 10 days of moving.

•Permanent Resident Card for any applicant who is not a United States citizen

NOTE: If you are not a citizen of the United States, you must provide your Permanent Resident Card to qualify for Homestead Exemption.

3.Please gather at least two of the following residency verification documents for each person applying:

•Florida Voter Registration Card with Homestead address **PREFERRED**

•Florida Vehicle Registration with Homestead address

•Most recent utility bill with Homestead address (We do not accept Water Utility, Frontier or DirecTV statements)

•Declaration of domicile filed in the public record

•Employment verification with Homestead address

•School location for dependent children (document must state student's home address)

•Most recent bank statement with Homestead address

•Additional, exemption-specific, supporting documentation may also be required. Click here to see a summary of requirements and documentation for most exemptions.

After You Apply

1.If you apply online, be sure to print a copy of the Exemption Filing Receipt.

2.Ensure that you have provided all required supporting documentation for all exemptions for which you applied.

3.Incomplete applications or applications submitted without the required documentation will not be approved.

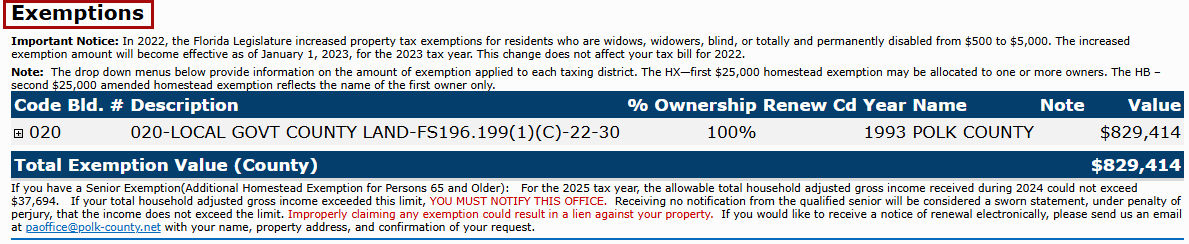

4.You will receive an email when your exemption application is either approved or denied. You may also check the status of your exemption at the Property Appraiser's website (www.polkpa.org) by searching for the property and viewing the exemptions section of the parcel detail page.