Information on income Limited Exemptions

The exemptions listed below have an income requirement. The income requirement for the exemption is set by the State of Florida and adjusted annually. Click here for the current income limitation rate.

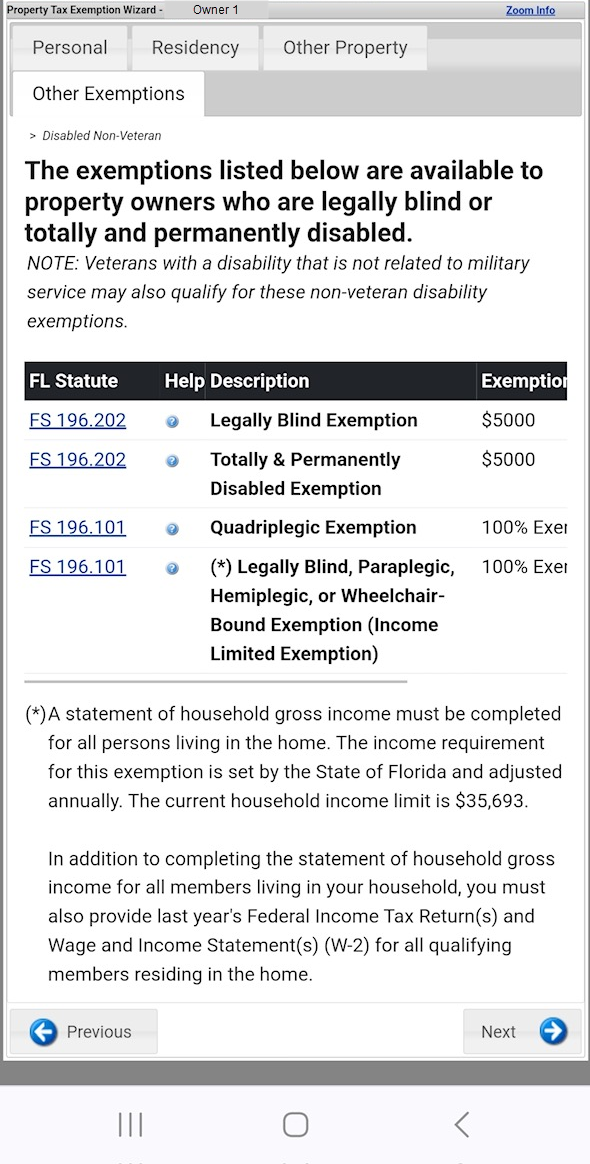

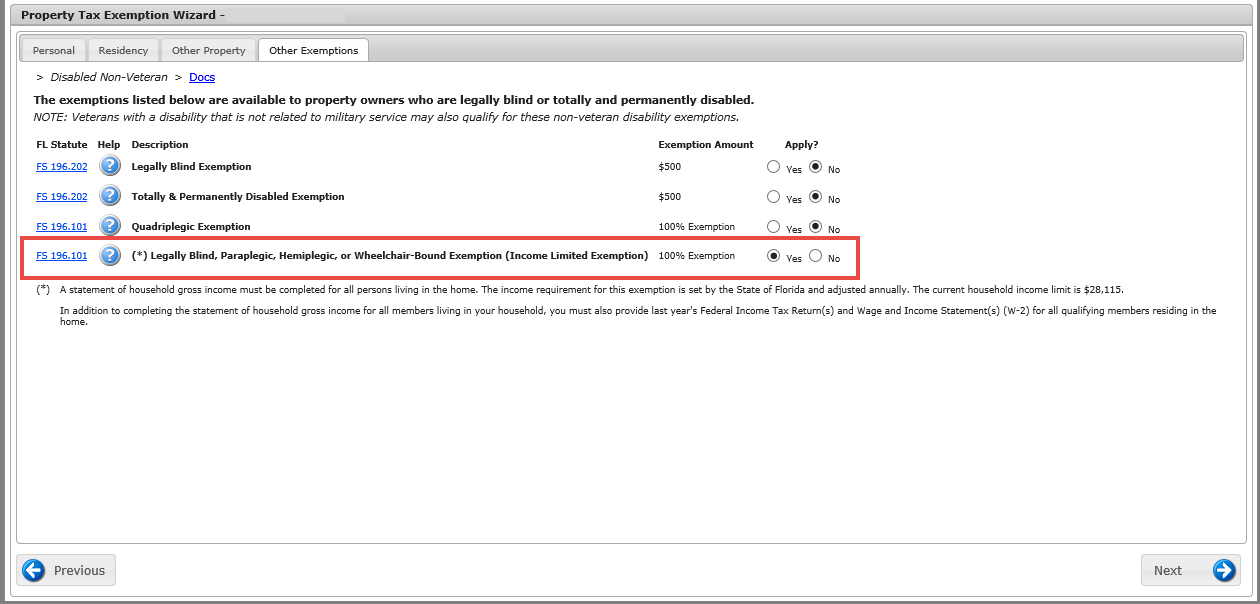

•Legally Blind, Paraplegic, Hemiplegic, or Wheelchair-Bound Exemption (Income Limited Exemption)

•To qualify for 100% exemption as Legally Blind, Paraplegic, Hemiplegic, or Wheelchair-Bound, a statement of household gross income must be completed for all persons living in the home.

•The term “gross income” includes United States Department of Veterans Affairs benefits and any Social Security benefits paid to the individual. The 2018 household income limit is $29,415.

•Senior Exemption (Age 65 and older) and Senior Long-Tern Exemption (Age 65 and older / 25+ year Residency)

•To qualify for the Senior Exemption, a statement of household adjusted gross income must be completed for all persons living in the home.

•The term "adjusted gross income" refers to, in the case of an individual, gross income minus the deductions outlined in s. 62 of the US IRS Code. The 2018 household income limit is $30,174.

To qualify for an exemption that has an income requirement, a statement of household income (gross or adjusted gross) must be completed for every household member. A household is defined as a person or group of persons living together in a room or group of rooms as a housing unit. This term does not include persons boarding in or renting a portion of the dwelling.

In addition to completing the statement of household income (gross or adjusted gross) for all members living in the household, the applicant must also provide last year's Federal Income Tax Return(s). If a person's income is below the filing thresholds for the Internal Revenue Service (IRS) and the person does not file an income tax return, the Income Worksheet must be completed.

All Wage and Income Statement(s) (W-2) and / or Form 1099's for all qualifying members residing in the home must also be submitted.

Mobile version:

Note: You will need to swipe within the table to scroll right and see the rest of the table to select the exemption you are applying for.