Exemptions on the Selected Parcel

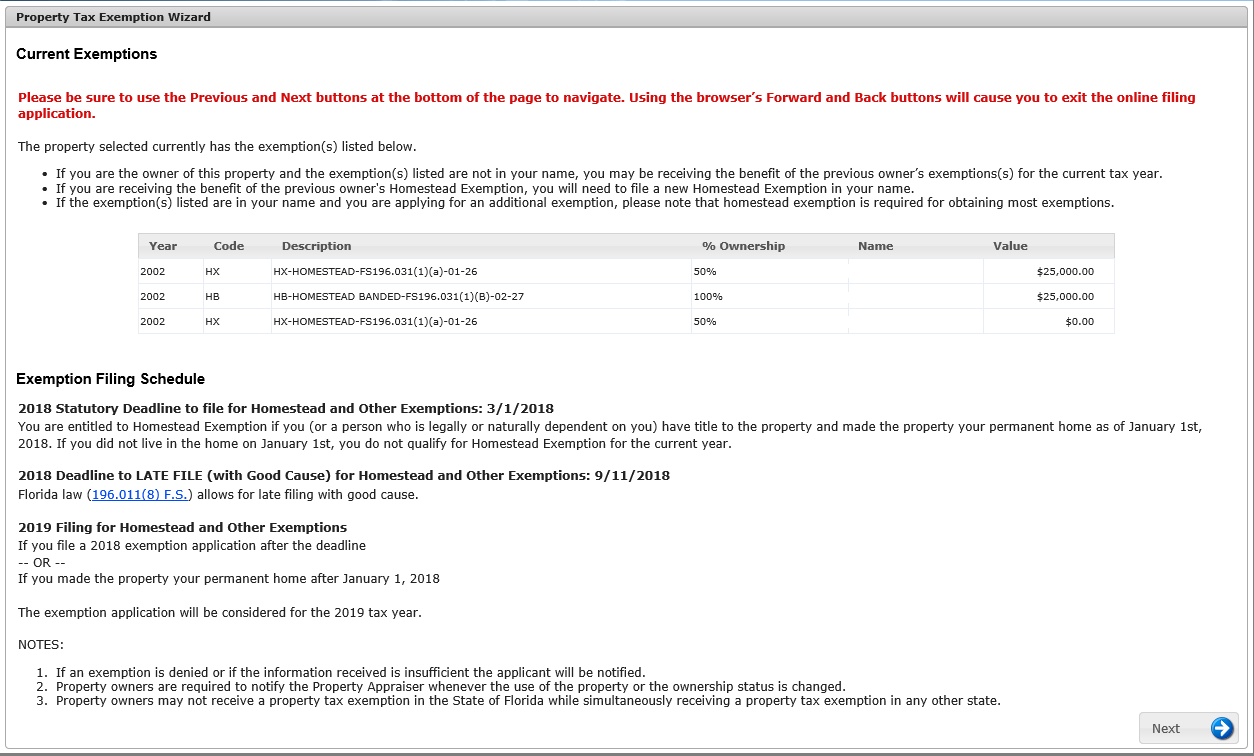

The Current Exemptions page is provided to ensure the applicant is aware of existing exemptions on the selected parcel/property.

•If you are the owner of the property and the exemption(s) listed are not in your name, you may be receiving the benefit of the previous owner's exemptions(s) for the current tax year.

•If there are no exemptions on the parcel OR you are receiving the benefit of the previous owner's Homestead Exemption, you will need to file a new Homestead Exemption in your name.

•If the exemption(s) listed are in your name and you are applying for an additional exemption, please note that Homestead Exemption is required for obtaining most exemptions.

Exemption Filing Schedule

Statutory Deadline to file for Homestead and Other Exemptions: March 1st*

You are entitled to Homestead Exemption for the current year, if you (or a person who is legally or naturally dependent on you) have title to the property and made the property your permanent home as of January 1st. If you did not live in the home on January 1st, you do not qualify for Homestead Exemption for the current year.

Deadline to LATE FILE (with Good Cause) for Homestead and Other Exemptions: Mid September**

Florida law (196.011(8) F.S.) allows for late filing with good cause. Late exemption applications are accepted until 25 days after the Notice of Proposed Property Taxes, also called TRIM (Truth in Millage) Notices are mailed.

Filing for Homestead and Other Exemptions

If you file an exemption application after Mid September

-- OR--

If you made the property your permanent home after January 1

The exemption will be considered for the following tax year.

*If March 1st falls on a weekend the deadline will be moved to the next business day. The actual date will always be updated on the Current Exemptions page of the exemption application.

**The actual date in September will always be updated on the Current Exemptions page of the exemption application.

NOTES:

1.If an exemption is denied or the information received is insufficient the applicant will be notified.

2.Property owners are required to notify the Property Appraiser whenever the use of the property or the ownership status is changed.

3.Property owners may not avail themselves of a property tax exemption in the State of Florida while simultaneously receiving a property tax exemption in any other state.

4.Incomplete applications or applications submitted without the required documentation will not be approved.

Mobile Version: